TrueMoney Wallet

Accept online payments from one of Thailand's most popular e-wallets with 30M+ active users. Customers are redirected to enter their phone number and authorize with OTP.

For offline QR code-based payments, see TrueMoney QR. This page covers the online redirect flow.

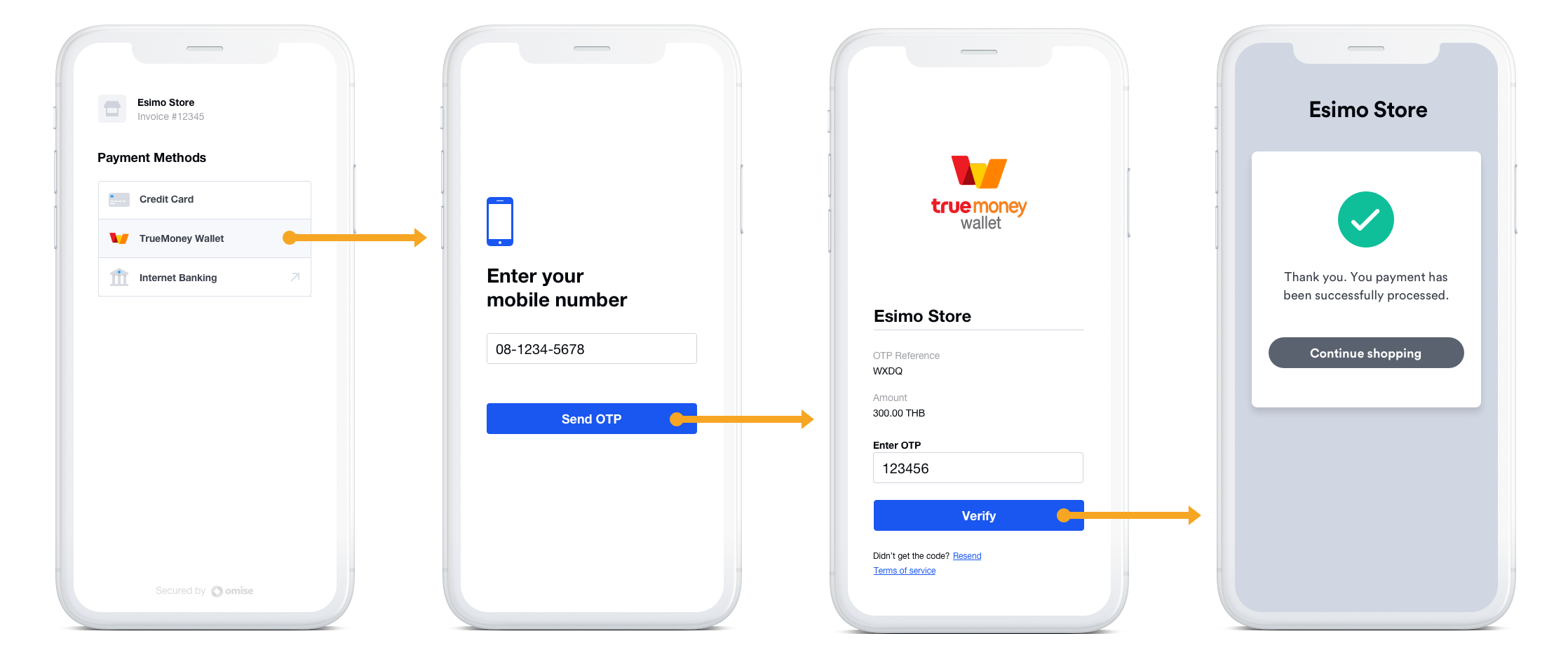

Payment Flow

The image above shows the complete redirect payment flow using one-time password (OTP) verification.

Overview

Payment method features, limits, user statistics, and fees are subject to change. Information is based on publicly available sources and may not reflect your specific merchant agreement. Always refer to official Omise documentation and your merchant dashboard for current, binding information.

User numbers are approximate and based on publicly available information. Actual active user counts may vary.

TrueMoney Wallet is a leading mobile payment solution in Thailand with over 30M+ users. The wallet allows customers to pay using their mobile phone number with OTP verification for added security.

Key Features:

- ✅ Large user base - 30M+ active users in Thailand

- ✅ Simple flow - Phone number + OTP authentication

- ✅ Quick settlement - Faster than traditional banking

- ✅ Mobile-first - Optimized for smartphone users

- ✅ Trusted brand - Part of Ascend Group (CP Group)

Supported Regions

| Region | Currency | Min Amount | Max Amount | Daily Limit |

|---|---|---|---|---|

| Thailand | THB | ฿20.00 | ฿100,000 | ฿40,000 - ฿200,000* |

*Daily limits vary based on customer's KYC verification level

Transaction Limits by Verification Level

| Verification Level | Per Transaction | Daily Limit | Monthly Limit |

|---|---|---|---|

| Basic (Phone only) | ฿100,000 | ฿40,000 | ฿200,000 |

| Plus (ID card) | ฿100,000 | ฿100,000 | ฿500,000 |

| Premium (Bank account) | ฿100,000 | ฿200,000 | Unlimited |

How It Works

Customer Experience:

- Customer selects TrueMoney at checkout

- Enters mobile phone number

- Receives OTP via SMS

- Enters OTP to authorize

- Confirms payment amount

- Returns to merchant site

Implementation

Step 1: Create TrueMoney Source

- cURL

- Node.js

- PHP

- Python

curl https://api.omise.co/sources \

-u skey_test_YOUR_SECRET_KEY: \

-d "type=truemoney" \

-d "amount=50000" \

-d "currency=THB" \

-d "phone_number=+66876543210"

const omise = require('omise')({

secretKey: 'skey_test_YOUR_SECRET_KEY'

});

const source = await omise.sources.create({

type: 'truemoney',

amount: 50000, // THB 500.00

currency: 'THB',

phone_number: '+66876543210'

});

<?php

$source = OmiseSource::create(array(

'type' => 'truemoney',

'amount' => 50000,

'currency' => 'THB',

'phone_number' => '+66876543210'

));

?>

import omise

omise.api_secret = 'skey_test_YOUR_SECRET_KEY'

source = omise.Source.create(

type='truemoney',

amount=50000,

currency='THB',

phone_number='+66876543210'

)

Response:

{

"object": "source",

"id": "src_test_5rt6s9vah5lkvi1rh9c",

"type": "truemoney",

"flow": "redirect",

"amount": 50000,

"currency": "THB",

"phone_number": "+66876543210"

}

Step 2: Create Charge

curl https://api.omise.co/charges \

-u skey_test_YOUR_SECRET_KEY: \

-d "amount=50000" \

-d "currency=THB" \

-d "source=src_test_5rt6s9vah5lkvi1rh9c" \

-d "return_uri=https://yourdomain.com/payment/callback"

Step 3: Redirect Customer

app.post('/create-truemoney-payment', async (req, res) => {

// Create source

const source = await omise.sources.create({

type: 'truemoney',

amount: req.body.amount,

currency: 'THB',

phone_number: req.body.phone_number

});

// Create charge

const charge = await omise.charges.create({

amount: req.body.amount,

currency: 'THB',

source: source.id,

return_uri: 'https://yourdomain.com/payment/callback',

metadata: {

order_id: req.body.order_id

}

});

// Redirect customer

res.redirect(charge.authorize_uri);

});

Step 4: Handle Return

app.get('/payment/callback', async (req, res) => {

const chargeId = req.query.charge_id;

// Retrieve charge status

const charge = await omise.charges.retrieve(chargeId);

if (charge.status === 'successful') {

// Payment successful

await processOrder(charge.metadata.order_id);

res.redirect('/payment-success');

} else if (charge.status === 'failed') {

// Payment failed

res.redirect('/payment-failed?reason=' + charge.failure_message);

} else {

// Still pending

res.redirect('/payment-pending');

}

});

Step 5: Handle Webhook

app.post('/webhooks/omise', (req, res) => {

const event = req.body;

if (event.key === 'charge.complete' && event.data.source.type === 'truemoney') {

const charge = event.data;

if (charge.status === 'successful') {

processOrder(charge.metadata.order_id);

}

}

res.sendStatus(200);

});

Complete Implementation Example

// Express.js server

const express = require('express');

const omise = require('omise')({

secretKey: process.env.OMISE_SECRET_KEY

});

const app = express();

app.use(express.json());

// Checkout page

app.post('/checkout/truemoney', async (req, res) => {

try {

const { amount, phone_number, order_id } = req.body;

// Validate phone number format

if (!/^\+66\d{9}$/.test(phone_number)) {

return res.status(400).json({

error: 'Invalid phone number. Use format: +66876543210'

});

}

// Check amount limits

if (amount < 2000 || amount > 10000000) {

return res.status(400).json({

error: 'Amount must be between ฿20 and ฿100,000'

});

}

// Create source

const source = await omise.sources.create({

type: 'truemoney',

amount: amount,

currency: 'THB',

phone_number: phone_number

});

// Create charge

const charge = await omise.charges.create({

amount: amount,

currency: 'THB',

source: source.id,

return_uri: `${process.env.BASE_URL}/payment/callback`,

metadata: {

order_id: order_id,

customer_phone: phone_number

}

});

// Return authorization URL

res.json({

authorize_uri: charge.authorize_uri,

charge_id: charge.id

});

} catch (error) {

console.error('TrueMoney payment error:', error);

res.status(500).json({ error: error.message });

}

});

// Callback handler

app.get('/payment/callback', async (req, res) => {

try {

const chargeId = req.query.charge_id;

const charge = await omise.charges.retrieve(chargeId);

if (charge.status === 'successful') {

res.redirect(`/order-success?order=${charge.metadata.order_id}`);

} else {

res.redirect(`/payment-failed?charge=${chargeId}`);

}

} catch (error) {

res.redirect('/payment-error');

}

});

// Webhook handler

app.post('/webhooks/omise', (req, res) => {

const event = req.body;

if (event.key === 'charge.complete') {

const charge = event.data;

if (charge.source.type === 'truemoney') {

if (charge.status === 'successful') {

// Process order

updateOrderStatus(charge.metadata.order_id, 'paid');

sendConfirmation(charge.metadata.customer_phone);

} else {

// Handle failure

updateOrderStatus(charge.metadata.order_id, 'failed');

}

}

}

res.sendStatus(200);

});

app.listen(3000);

Void and Refund Support

Voiding Charges

TrueMoney supports voiding within 24 hours of charge creation:

// Void immediately (full or partial)

const refund = await omise.charges.refund('chrg_test_...', {

amount: 50000 // Full amount

});

if (refund.voided) {

console.log('Charge was voided (within 24 hours)');

}

Refunds

Full refunds only within 30 days:

// Full refund only

const refund = await omise.charges.refund('chrg_test_...', {

amount: 50000 // Must be full amount

});

TrueMoney Wallet does NOT support partial refunds. Only full refunds are allowed within 30 days.

Common Issues & Troubleshooting

Issue: "Invalid phone number"

Causes:

- Wrong format

- Missing country code

- Non-Thai number

Solution:

function validateThaiPhone(phone) {

// Accept formats: +66876543210, 0876543210

let normalized = phone.replace(/\s/g, '');

if (normalized.startsWith('0')) {

normalized = '+66' + normalized.substring(1);

}

if (!/^\+66\d{9}$/.test(normalized)) {

throw new Error('Invalid Thai phone number');

}

return normalized;

}

Issue: Customer exceeds daily limit

Error: Transaction rejected

Solution:

- Customer needs to upgrade TrueMoney account verification

- Split payment across multiple days

- Use alternative payment method

Issue: Payment pending too long

Cause: Customer didn't complete OTP verification

Solution:

- Set 15-20 minute timeout

- Allow customer to retry with new charge

- Show clear instructions

Issue: Return URI not called

Cause: Customer closed browser

Solution:

- Implement webhook handling (more reliable)

- Provide order status check page

- Send SMS confirmation to customer

Best Practices

1. Validate Phone Numbers

const phoneRegex = /^\+66[0-9]{9}$/;

if (!phoneRegex.test(phoneNumber)) {

return res.status(400).json({

error: 'Please enter a valid Thai phone number (e.g., +66876543210)'

});

}

2. Show Clear Instructions

<div class="truemoney-instructions">

<h3>Pay with TrueMoney Wallet</h3>

<ol>

<li>Enter your TrueMoney-registered phone number</li>

<li>You'll receive an OTP via SMS</li>

<li>Enter the OTP to authorize payment</li>

<li>Confirm the amount</li>

</ol>

<p>Make sure you have sufficient balance in your TrueMoney Wallet.</p>

</div>

3. Handle Timeouts

// Set reasonable timeout

setTimeout(() => {

if (!paymentConfirmed) {

showTimeoutMessage();

allowRetry();

}

}, 15 * 60 * 1000); // 15 minutes

4. Use Webhooks

Don't rely solely on redirect callbacks:

// Webhook is more reliable

app.post('/webhooks/omise', handleWebhook);

// Callback is backup

app.get('/payment/callback', handleCallback);

5. Provide Customer Support

metadata: {

order_id: orderId,

customer_phone: phoneNumber,

customer_email: email,

support_ticket: ticketId

}

FAQ

What is TrueMoney Wallet?

TrueMoney Wallet is a mobile payment app in Thailand with 30M+ users. Customers can load money into their wallet and pay using their phone number with OTP authentication.

Do customers need to register first?

Yes, customers must have an existing TrueMoney Wallet account. They can download the app and register with their Thai phone number.

What are the transaction fees?

Check your Omise dashboard for current rates. E-wallet fees are typically lower than credit cards.

How long does settlement take?

Settlements are typically faster than credit cards. Check with Omise support for specific timelines.

Can international customers use TrueMoney?

TrueMoney is only available for customers in Thailand with Thai phone numbers and Thai bank accounts.

What if customer has insufficient balance?

Payment will fail. Customer can top up their TrueMoney Wallet via:

- 7-Eleven stores

- Bank transfer

- Credit/debit card

- TrueMoney kiosks

Then retry the payment.

Testing

Test Mode

TrueMoney Wallet can be tested in test mode using your test API keys. In test mode:

Test Credentials:

- Use any valid Thai phone number format (+66XXXXXXXXX)

- Test charges will not actually debit customer accounts

- All test data uses test API keys (skey_test_xxx)

Test Flow:

- Create a source and charge using test API keys

- You'll receive an

authorize_urifor redirect - In test mode, manually mark charges as successful/failed in dashboard

- Webhooks will be triggered based on status changes

Testing Status Changes:

// Create test charge

const charge = await omise.charges.create({

amount: 50000,

currency: 'THB',

source: testSourceId,

return_uri: 'https://example.com/callback'

});

// In test mode, use Omise Dashboard to:

// 1. Navigate to the charge

// 2. Use "Actions" menu to mark as successful or failed

// 3. Verify webhook handling

Test Scenarios:

- Successful payment: Verify order fulfillment workflow

- Failed payment: Test error handling and retry logic

- Timeout: Test abandoned payment scenarios

- Webhook delivery: Ensure all webhooks are properly received

Important Notes:

- Test mode QR codes will redirect but won't connect to real TrueMoney servers

- Use the dashboard to simulate payment completion

- Always test webhook handling before going live

- Verify amount limits and validation logic

For comprehensive testing guidelines, see the Testing Documentation.

Related Resources

- Digital Wallets Overview - All wallet options

- TrueMoney QR - Offline QR payments

- GrabPay - Alternative wallet

- Rabbit LINE Pay - Another Thai wallet

- Refunds - Refund policies

- Testing - Test TrueMoney integration