OCBC Mobile Banking

Accept instant payments via OCBC Mobile app from OCBC Bank, one of Singapore's three major local banks with comprehensive digital banking services.

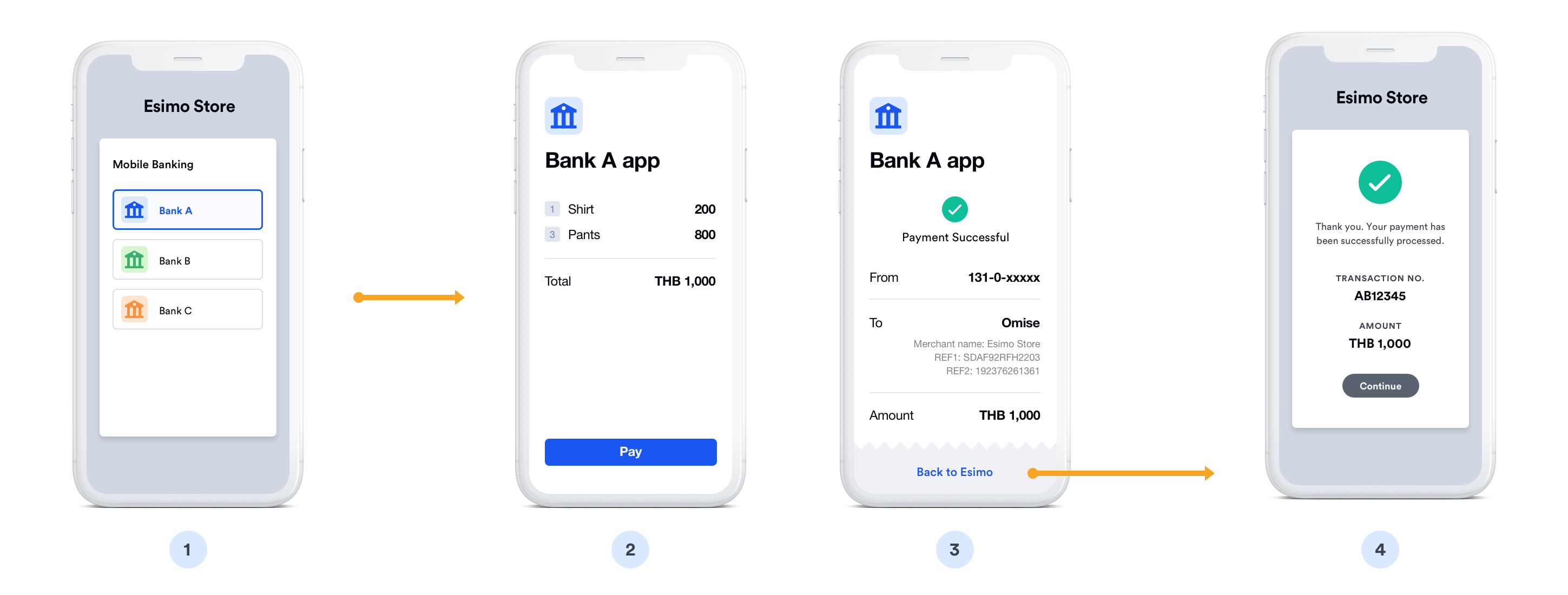

Payment Flow

Step-by-step mobile banking payment process:

❶ Select Bank - Customer chooses their bank at merchant checkout

❷ Redirect to bank - System redirects to bank's payment authorization page

❸ Open banking app - Deep link automatically launches the bank's mobile app

- On iOS: Opens via Universal Links

- On Android: Opens via App Links

- Customer sees "Open in [Bank] App" prompt

❹ Authenticate - Customer logs into banking app (if not already logged in)

- PIN entry (6 digits)

- Fingerprint scan

- Face ID recognition

❺ Review payment - Transaction details displayed in app:

- Merchant name

- Payment amount

- Order reference

- Account to debit from

❻ Authorize payment - Customer confirms the transaction

- Enter additional PIN/OTP if required by bank

- Tap "Confirm Payment" button

❼ Payment processed - Bank immediately transfers funds

❽ Confirmation - Success screen shown in app

- Transaction reference number

- Receipt available for download

❾ Return to merchant - Customer redirected back to merchant website

- Automatic redirect or "Return to Merchant" button

- Order confirmation page displayed

Typical completion time: 30-90 seconds

Overview

OCBC Bank is one of Singapore's leading financial institutions and the second largest bank in Southeast Asia by assets. OCBC Mobile provides customers with seamless mobile banking including instant payment authorization.

Key Features:

- ✅ Fast confirmation - Near real-time payment verification (typically within seconds)

- ✅ Major Singapore bank - One of the Big 3 local banks

- ✅ High limits - Large transaction support

- ✅ Trusted institution - 90+ years of banking excellence

- ✅ 24/7 availability - Works anytime

- ✅ Refund support - Full and partial refunds

Supported Region

| Region | Currency | Min Amount | Max Amount | Daily Limit |

|---|---|---|---|---|

| Singapore | SGD | $0.01 | $500,000 | Varies* |

*Daily limits depend on customer's account type and settings

How It Works

Customer selects OCBC → OCBC Mobile app opens → Authenticates → Confirms payment → Returns to merchant (30-90 seconds)

Implementation

Create Source and Charge

- Node.js

- PHP

- Python

const omise = require('omise')({

secretKey: 'skey_test_YOUR_SECRET_KEY'

});

// Create source

const source = await omise.sources.create({

type: 'mobile_banking_ocbc',

amount: 10000, // SGD 100.00

currency: 'SGD'

});

// Create charge

const charge = await omise.charges.create({

amount: 10000,

currency: 'SGD',

source: source.id,

return_uri: 'https://yourdomain.com/payment/callback'

});

// Redirect to OCBC Mobile app

res.redirect(charge.authorize_uri);

<?php

$source = OmiseSource::create(array(

'type' => 'mobile_banking_ocbc',

'amount' => 10000,

'currency' => 'SGD'

));

$charge = OmiseCharge::create(array(

'amount' => 10000,

'currency' => 'SGD',

'source' => $source['id'],

'return_uri' => 'https://yourdomain.com/payment/callback'

));

header('Location: ' . $charge['authorize_uri']);

?>

import omise

omise.api_secret = 'skey_test_YOUR_SECRET_KEY'

source = omise.Source.create(

type='mobile_banking_ocbc',

amount=10000,

currency='SGD'

)

charge = omise.Charge.create(

amount=10000,

currency='SGD',

source=source.id,

return_uri='https://yourdomain.com/payment/callback'

)

return redirect(charge.authorize_uri)

Refund Support

// Full or partial refund within 30 days

const refund = await omise.charges.refund('chrg_test_...', {

amount: 10000 // Full or partial amount

});

Testing

Test Amount: SGD 100.00 (10000 smallest unit) Expected: Successful payment in test mode

FAQ

What is OCBC Bank?

OCBC Bank is one of Singapore's three major local banks and the second largest bank in Southeast Asia by assets. It has a strong presence in Singapore and the region.

What are the transaction limits?

- Minimum: $0.01 SGD

- Maximum: $500,000 SGD per transaction

- Actual limits depend on customer's account settings

Can I refund OCBC payments?

Yes, full and partial refunds are supported within 30 days of the original transaction.

Related Resources

- Mobile Banking Overview - All mobile banking options

- Bank Transfers Overview - All bank payment methods

- PayNow - Singapore QR payment alternative

- Testing - Test your integration