PayNow QR

Accept instant QR code payments through PayNow, Singapore's national peer-to-peer fast payment system with 4+ million registered users and backed by all major banks.

Payment Flow Examples

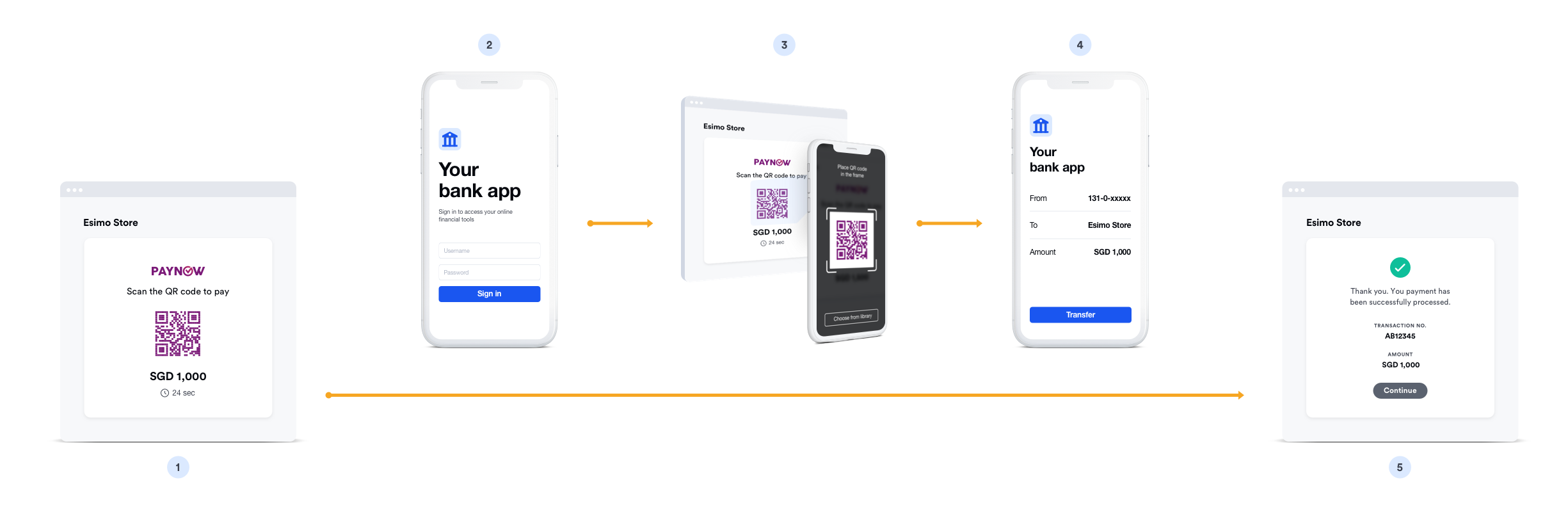

Desktop Browser Flow:

The desktop payment process:

- ❶ Initiate payment - Customer clicks "Pay with PayNow" at checkout

- ❷ Generate QR code - System generates unique PayNow QR code

- ❸ Display QR - QR code shown on screen with payment amount

- ❹ Scan with mobile - Customer scans using any Singapore banking app

- ❺ Open banking app - QR automatically launches the banking app

- ❻ Verify details - Customer reviews merchant name and amount

- ❼ Authenticate - Confirm with PIN, fingerprint, or Face ID

- ❽ Complete - Instant confirmation, return to merchant website

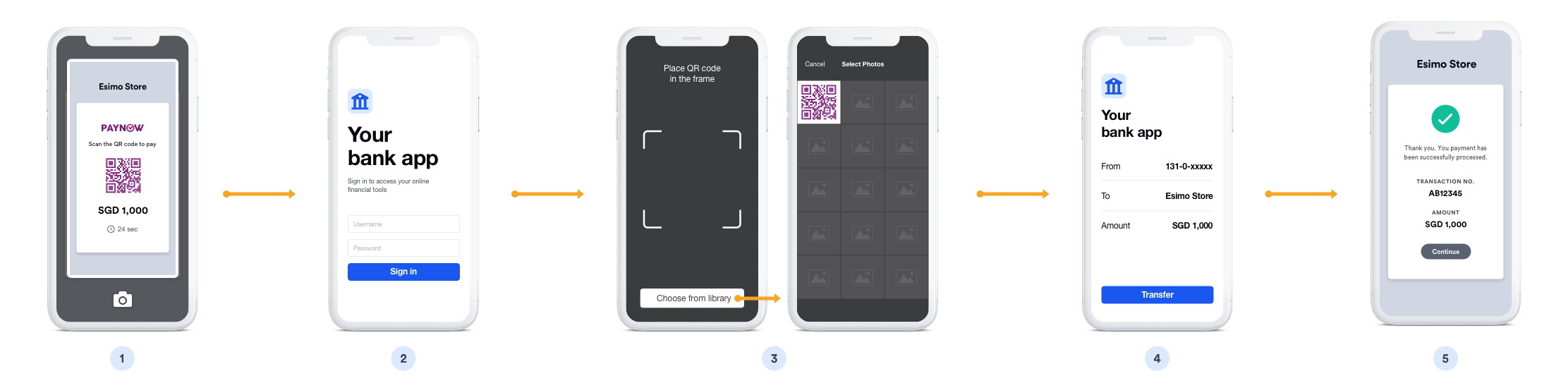

Mobile Browser Flow:

Optimized mobile experience:

- ❶ Select PayNow - Customer chooses PayNow payment method

- ❷ QR displayed - PayNow QR code appears on mobile screen

- ❸ Switch to bank app - Customer taps to open banking app

- ❹ Auto-scan - Banking app automatically reads payment details

- ❺ Review payment - Pre-populated transaction information

- ❻ Confirm - Single tap to authorize with biometric/PIN

- ❼ Success - Immediate confirmation and redirect

Overview

PayNow is Singapore's national real-time payment infrastructure operated by the Banking Computer Services (BCS). It enables instant fund transfers between bank accounts using mobile numbers, NRIC/FIN, or QR codes. Customers scan a QR code to pay directly from their bank accounts.

Key Features:

- ✅ National system - All major Singapore banks supported

- ✅ Fast confirmation - Near real-time payment verification (typically within seconds)

- ✅ 4+ million users - Wide adoption across Singapore

- ✅ QR code payment - No app downloads required

- ✅ Bank-to-bank - Direct transfer from customer's bank account

- ✅ High security - Bank-level authentication

- ✅ 24/7 availability - Works anytime, including holidays

Supported Regions

| Region | Currency | Min Amount | Max Amount | Per Transaction |

|---|---|---|---|---|

| Singapore | SGD | $0.50 | $200,000 | No daily limit |

Supported Banks

All major Singapore banks support PayNow:

- DBS/POSB

- OCBC Bank

- UOB

- Standard Chartered

- Citibank

- HSBC

- Maybank

- ANZ

- And more...

How It Works

Customer Experience:

- Customer selects "PayNow" at checkout

- QR code is displayed on screen

- Customer opens their bank's mobile app

- Scans the QR code

- Reviews and confirms payment in banking app

- Payment completed instantly

- Returns to merchant site

Typical completion time: 30 seconds - 2 minutes

Implementation

Step 1: Create PayNow Source

- cURL

- Node.js

- PHP

- Python

- Ruby

- Go

- Java

- C#

curl https://api.omise.co/sources \

-u skey_test_YOUR_SECRET_KEY: \

-d "type=paynow" \

-d "amount=10000" \

-d "currency=SGD"

const omise = require('omise')({

secretKey: 'skey_test_YOUR_SECRET_KEY'

});

const source = await omise.sources.create({

type: 'paynow',

amount: 10000, // SGD 100.00

currency: 'SGD'

});

<?php

$source = OmiseSource::create(array(

'type' => 'paynow',

'amount' => 10000,

'currency' => 'SGD'

));

?>

import omise

omise.api_secret = 'skey_test_YOUR_SECRET_KEY'

source = omise.Source.create(

type='paynow',

amount=10000,

currency='SGD'

)

require 'omise'

Omise.api_key = 'skey_test_YOUR_SECRET_KEY'

source = Omise::Source.create({

type: 'paynow',

amount: 10000,

currency: 'SGD'

})

source, err := client.Sources().Create(&operations.CreateSource{

Type: "paynow",

Amount: 10000,

Currency: "SGD",

})

Source source = client.sources().create(new Source.CreateParams()

.type("paynow")

.amount(10000L)

.currency("SGD"));

var source = await client.Sources.Create(new CreateSourceRequest

{

Type = "paynow",

Amount = 10000,

Currency = "SGD"

});

Response:

{

"object": "source",

"id": "src_test_5rt6s9vah5lkvi1rh9c",

"type": "paynow",

"flow": "offline",

"amount": 10000,

"currency": "SGD",

"scannable_code": {

"type": "qr",

"image": {

"download_uri": "https://api.omise.co/charges/.../documents/qr_code.png"

}

}

}

Step 2: Display QR Code

app.post('/checkout/paynow', async (req, res) => {

try {

const { amount, order_id } = req.body;

// Validate amount

if (amount < 50 || amount > 20000000) {

return res.status(400).json({

error: 'Amount must be between $0.50 and $200,000'

});

}

// Create source

const source = await omise.sources.create({

type: 'paynow',

amount: amount,

currency: 'SGD'

});

// Create charge

const charge = await omise.charges.create({

amount: amount,

currency: 'SGD',

source: source.id,

metadata: {

order_id: order_id

}

});

// Return QR code URL

res.json({

qr_code_url: source.scannable_code.image.download_uri,

charge_id: charge.id,

expires_at: new Date(Date.now() + 15 * 60 * 1000) // 15 min

});

} catch (error) {

console.error('PayNow error:', error);

res.status(500).json({ error: error.message });

}

});

Step 3: Frontend Display

<!DOCTYPE html>

<html>

<head>

<title>Pay with PayNow</title>

<style>

.paynow-container {

max-width: 500px;

margin: 50px auto;

text-align: center;

padding: 30px;

border: 1px solid #ddd;

border-radius: 8px;

}

.qr-code {

width: 300px;

height: 300px;

margin: 20px auto;

border: 2px solid #0052CC;

padding: 10px;

background: white;

}

.timer {

font-size: 24px;

color: #d32f2f;

margin: 20px 0;

}

.instructions {

text-align: left;

margin: 20px 0;

}

</style>

</head>

<body>

<div class="paynow-container">

<h2>Scan to Pay with PayNow</h2>

<p class="amount">Amount: $<span id="amount">100.00</span></p>

<img id="qr-code" class="qr-code" alt="PayNow QR Code" />

<div class="timer">

Time remaining: <span id="countdown">15:00</span>

</div>

<div class="instructions">

<h3>How to pay:</h3>

<ol>

<li>Open your bank's mobile app</li>

<li>Select "PayNow" or "Scan to Pay"</li>

<li>Scan the QR code above</li>

<li>Confirm the payment amount</li>

<li>Authorize with your PIN/biometric</li>

</ol>

</div>

<p id="status">Waiting for payment...</p>

</div>

<script>

// Initialize payment

async function initPayment() {

const response = await fetch('/checkout/paynow', {

method: 'POST',

headers: { 'Content-Type': 'application/json' },

body: JSON.stringify({

amount: 10000, // $100.00

order_id: '12345'

})

});

const data = await response.json();

// Display QR code

document.getElementById('qr-code').src = data.qr_code_url;

// Start countdown

startCountdown(15 * 60); // 15 minutes

// Poll for payment status

pollPaymentStatus(data.charge_id);

}

// Countdown timer

function startCountdown(seconds) {

const countdownEl = document.getElementById('countdown');

const interval = setInterval(() => {

const mins = Math.floor(seconds / 60);

const secs = seconds % 60;

countdownEl.textContent =

`${mins}:${secs.toString().padStart(2, '0')}`;

if (seconds <= 0) {

clearInterval(interval);

showExpired();

}

seconds--;

}, 1000);

}

// Poll payment status

async function pollPaymentStatus(chargeId) {

const interval = setInterval(async () => {

const response = await fetch(`/charge-status/${chargeId}`);

const charge = await response.json();

if (charge.status === 'successful') {

clearInterval(interval);

showSuccess();

} else if (charge.status === 'failed') {

clearInterval(interval);

showFailed();

}

}, 3000); // Poll every 3 seconds

}

function showSuccess() {

document.getElementById('status').innerHTML =

'<span style="color: green;">✓ Payment successful!</span>';

setTimeout(() => {

window.location = '/payment-success';

}, 2000);

}

function showFailed() {

document.getElementById('status').innerHTML =

'<span style="color: red;">✗ Payment failed. Please try again.</span>';

}

function showExpired() {

document.getElementById('status').innerHTML =

'<span style="color: orange;">⏱ Payment expired. Please create a new payment.</span>';

}

// Initialize on page load

initPayment();

</script>

</body>

</html>

Step 4: Status Polling

// Backend endpoint for checking charge status

app.get('/charge-status/:chargeId', async (req, res) => {

try {

const charge = await omise.charges.retrieve(req.params.chargeId);

res.json({

status: charge.status,

paid: charge.paid

});

} catch (error) {

res.status(500).json({ error: error.message });

}

});

Step 5: Handle Webhook

app.post('/webhooks/omise', (req, res) => {

const event = req.body;

if (event.key === 'charge.complete' && event.data.source.type === 'paynow') {

const charge = event.data;

if (charge.status === 'successful') {

// Payment confirmed

processOrder(charge.metadata.order_id);

sendConfirmationEmail(charge.metadata.customer_email);

} else if (charge.status === 'failed') {

// Payment failed

handleFailedPayment(charge.metadata.order_id);

}

}

res.sendStatus(200);

});

Complete Implementation Example

// Express.js server

const express = require('express');

const omise = require('omise')({

secretKey: process.env.OMISE_SECRET_KEY

});

const app = express();

app.use(express.json());

app.use(express.static('public'));

// Create PayNow payment

app.post('/checkout/paynow', async (req, res) => {

try {

const { amount, order_id, customer_email } = req.body;

// Validate amount

if (amount < 50 || amount > 20000000) {

return res.status(400).json({

error: 'Amount must be between $0.50 and $200,000'

});

}

// Create source

const source = await omise.sources.create({

type: 'paynow',

amount: amount,

currency: 'SGD'

});

// Create charge

const charge = await omise.charges.create({

amount: amount,

currency: 'SGD',

source: source.id,

metadata: {

order_id: order_id,

customer_email: customer_email

}

});

// Return payment details

res.json({

charge_id: charge.id,

qr_code_url: source.scannable_code.image.download_uri,

expires_at: new Date(Date.now() + 15 * 60 * 1000).toISOString()

});

} catch (error) {

console.error('PayNow error:', error);

res.status(500).json({ error: error.message });

}

});

// Check charge status

app.get('/charge-status/:chargeId', async (req, res) => {

try {

const charge = await omise.charges.retrieve(req.params.chargeId);

res.json({

status: charge.status,

paid: charge.paid,

amount: charge.amount

});

} catch (error) {

res.status(500).json({ error: error.message });

}

});

// Webhook handler

app.post('/webhooks/omise', (req, res) => {

const event = req.body;

if (event.key === 'charge.complete') {

const charge = event.data;

if (charge.source.type === 'paynow') {

if (charge.status === 'successful') {

updateOrderStatus(charge.metadata.order_id, 'paid');

sendPaymentConfirmation(charge.metadata.customer_email);

} else {

updateOrderStatus(charge.metadata.order_id, 'failed');

}

}

}

res.sendStatus(200);

});

app.listen(3000);

Refund Support

PayNow does NOT support refunds. Once a payment is completed, it cannot be refunded through the PayNow system. You must process refunds manually via bank transfer if needed.

Common Issues & Troubleshooting

Issue: QR code not displaying

Causes:

- Invalid QR code URL

- Image loading error

- CORS policy blocking

Solution:

// Add error handling

document.getElementById('qr-code').onerror = function() {

console.error('Failed to load QR code');

alert('Unable to load QR code. Please refresh the page.');

};

Issue: Payment timeout

Cause: Customer didn't scan QR within 15 minutes

Solution:

// Allow retry with new QR code

function retryPayment() {

initPayment(); // Generate new QR code

}

Issue: Customer scanned but didn't confirm

Cause: Customer scanned QR but cancelled in banking app

Solution:

- Show clear instructions

- Display countdown timer

- Allow multiple scan attempts

Best Practices

1. Display Clear Instructions

<div class="paynow-instructions">

<h3>How to pay with PayNow:</h3>

<ol>

<li>Open your bank's mobile app (DBS, OCBC, UOB, etc.)</li>

<li>Find "PayNow" or "Scan & Pay" option</li>

<li>Scan the QR code shown above</li>

<li>Verify the amount matches</li>

<li>Confirm with PIN or biometric</li>

<li>Wait for confirmation</li>

</ol>

<p><strong>Payment expires in 15 minutes</strong></p>

</div>

2. Implement Countdown Timer

function startCountdown(duration) {

let timer = duration;

const display = document.getElementById('countdown');

const interval = setInterval(() => {

const minutes = Math.floor(timer / 60);

const seconds = timer % 60;

display.textContent =

minutes + ":" + (seconds < 10 ? "0" : "") + seconds;

if (--timer < 0) {

clearInterval(interval);

handleExpiry();

}

}, 1000);

}

3. Poll for Status Updates

async function pollStatus(chargeId) {

const maxAttempts = 100; // 5 minutes (3s * 100)

let attempts = 0;

const interval = setInterval(async () => {

const status = await checkChargeStatus(chargeId);

if (status === 'successful' || status === 'failed') {

clearInterval(interval);

handlePaymentComplete(status);

}

if (++attempts >= maxAttempts) {

clearInterval(interval);

handleTimeout();

}

}, 3000);

}

4. Mobile-Responsive QR Code

.qr-code {

width: 100%;

max-width: 300px;

height: auto;

margin: 20px auto;

}

@media (max-width: 600px) {

.qr-code {

max-width: 250px;

}

}

5. Validate Amount

function validatePayNowAmount(amount) {

const MIN = 50; // $0.50

const MAX = 20000000; // $200,000

if (amount < MIN) {

return 'Minimum amount is $0.50';

}

if (amount > MAX) {

return 'Maximum amount is $200,000';

}

return null;

}

FAQ

What is PayNow?

PayNow is Singapore's national fast payment system that enables instant bank-to-bank transfers using mobile numbers, NRIC/FIN, or QR codes. All major Singapore banks support PayNow.

Do customers need a PayNow account?

No separate PayNow account is needed. Customers only need a Singapore bank account with any participating bank and their mobile banking app.

What banks support PayNow?

All major Singapore banks including DBS/POSB, OCBC, UOB, Standard Chartered, Citibank, HSBC, Maybank, and more.

How long is the QR code valid?

PayNow QR codes expire after 15 minutes. Generate a new QR code if payment is not completed within this time.

Can I refund PayNow payments?

No, PayNow does not support automated refunds. Refunds must be processed manually via bank transfer if needed.

What are the transaction limits?

- Minimum: $0.50

- Maximum: $200,000 per transaction

- No daily limit (subject to bank's own limits)

How long does payment confirmation take?

PayNow payments are confirmed instantly, typically within seconds after the customer confirms in their banking app.

Testing

Test Mode

PayNow can be tested using your test API keys. In test mode:

Test Credentials:

- Use test API keys (skey_test_xxx)

- Currency: SGD (Singapore Dollar)

- No actual bank account or PayNow registration required

Test Flow:

- Create source and charge with test API keys

- QR code is generated in test mode

- Test QR code displays but won't connect to real PayNow network

- Use Omise Dashboard Actions to mark charge as successful/failed

- Verify webhook handling and status polling

Testing Implementation:

// Test PayNow payment

const source = await omise.sources.create({

type: 'paynow',

amount: 5000, // $50.00

currency: 'SGD'

});

const charge = await omise.charges.create({

amount: 5000,

currency: 'SGD',

source: source.id

});

console.log('Test QR code URL:', charge.source.scannable_code.image.download_uri);

// Test status polling

async function pollPaymentStatus() {

const charge = await omise.charges.retrieve(chargeId);

console.log('Payment status:', charge.status);

}

Test Scenarios:

- Successful payment: Verify order completion workflow

- Failed payment: Test error handling

- QR code display: Test QR rendering on desktop and mobile

- Amount limits: Test $1 minimum and maximum amounts

- QR expiration: Test timeout handling (30 minutes default)

- Status polling: Verify polling mechanism works correctly

- Webhook delivery: Verify all webhook notifications

- Mobile vs Desktop: Test both user experiences

Important Notes:

- Test mode QR codes won't scan with real banking apps

- Use Omise Dashboard to simulate payment completion

- Test status polling intervals (recommended: every 3-5 seconds)

- Verify webhook handling for all charge statuses

- Test QR code expiration and regeneration flow

- Test both successful and timeout scenarios

For comprehensive testing guidelines, see the Testing Documentation.

Related Resources

- QR Payments Overview - All QR payment options

- PromptPay - Thailand's QR payment

- DuitNow QR - Malaysia's QR payment

- Testing - Test PayNow integration

- Webhooks - Handle payment notifications