Krungthai Mobile Banking (Krungthai NEXT)

Accept instant payments via Krungthai NEXT mobile app from Krungthai Bank, Thailand's state-owned bank with extensive nationwide reach and 5+ million users.

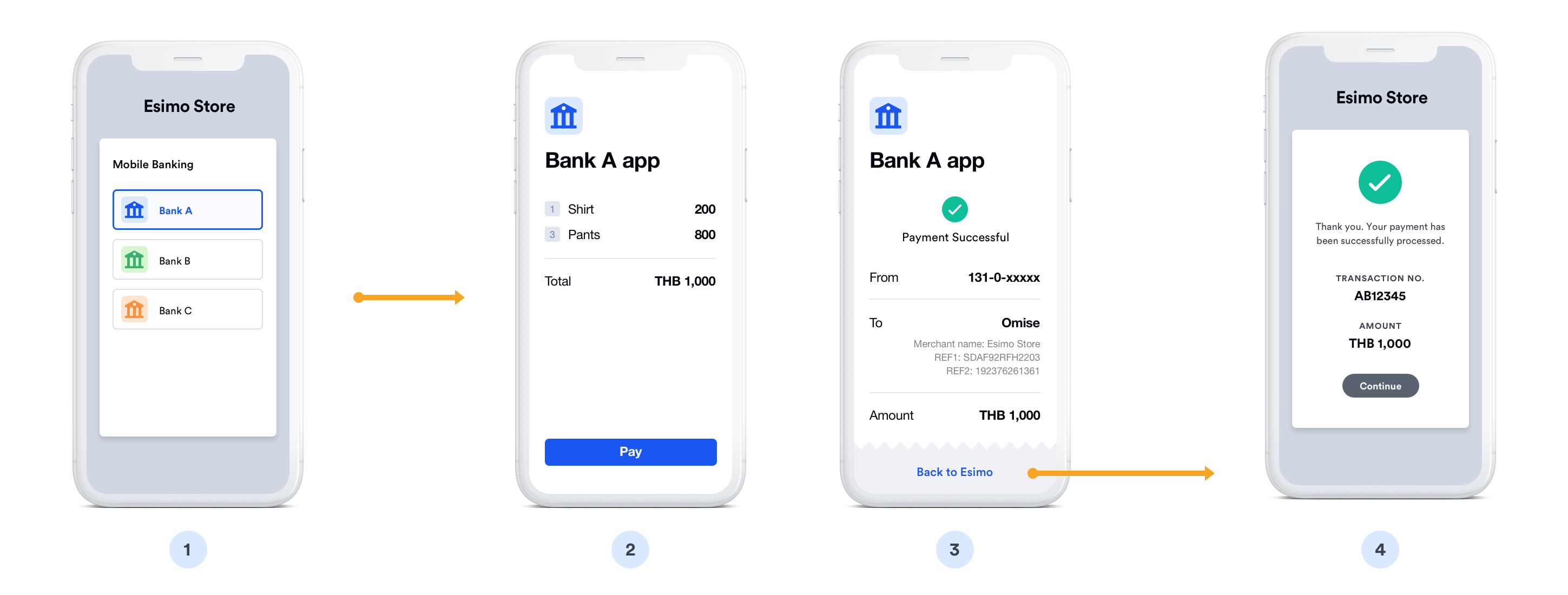

Payment Flow

Step-by-step mobile banking payment process:

❶ Select Bank - Customer chooses their bank at merchant checkout

❷ Redirect to bank - System redirects to bank's payment authorization page

❸ Open banking app - Deep link automatically launches the bank's mobile app

- On iOS: Opens via Universal Links

- On Android: Opens via App Links

- Customer sees "Open in [Bank] App" prompt

❹ Authenticate - Customer logs into banking app (if not already logged in)

- PIN entry (6 digits)

- Fingerprint scan

- Face ID recognition

❺ Review payment - Transaction details displayed in app:

- Merchant name

- Payment amount

- Order reference

- Account to debit from

❻ Authorize payment - Customer confirms the transaction

- Enter additional PIN/OTP if required by bank

- Tap "Confirm Payment" button

❼ Payment processed - Bank immediately transfers funds

❽ Confirmation - Success screen shown in app

- Transaction reference number

- Receipt available for download

❾ Return to merchant - Customer redirected back to merchant website

- Automatic redirect or "Return to Merchant" button

- Order confirmation page displayed

Typical completion time: 30-90 seconds

Overview

Krungthai NEXT is the mobile banking app from Krungthai Bank (KTB), a state-owned commercial bank and one of Thailand's largest financial institutions. With the widest branch network in Thailand, KTB serves customers across all provinces.

Key Features:

- ✅ Fast confirmation - Near real-time payment verification (typically within seconds)

- ✅ 5+ million users - Wide reach in rural and urban areas

- ✅ State-owned - Government bank with high trust

- ✅ High limits - Up to ฿150,000 per transaction

- ✅ Nationwide presence - 1,200+ branches across Thailand

- ✅ Refund support - Full and partial refunds

Supported Region

| Region | Currency | Min Amount | Max Amount | Daily Limit |

|---|---|---|---|---|

| Thailand | THB | ฿20.00 | ฿150,000 | Varies* |

*Daily limits depend on customer's account type and settings

How It Works

Customer selects Krungthai → NEXT app opens → Authenticates → Confirms payment → Returns to merchant (30-90 seconds total)

Implementation

Create Source and Charge

- Node.js

- PHP

- Python

const omise = require('omise')({

secretKey: 'skey_test_YOUR_SECRET_KEY'

});

// Create source

const source = await omise.sources.create({

type: 'mobile_banking_ktb',

amount: 100000, // ฿1,000

currency: 'THB'

});

// Create charge

const charge = await omise.charges.create({

amount: 100000,

currency: 'THB',

source: source.id,

return_uri: 'https://yourdomain.com/payment/callback'

});

// Redirect to KTB NEXT app

res.redirect(charge.authorize_uri);

<?php

$source = OmiseSource::create(array(

'type' => 'mobile_banking_ktb',

'amount' => 100000,

'currency' => 'THB'

));

$charge = OmiseCharge::create(array(

'amount' => 100000,

'currency' => 'THB',

'source' => $source['id'],

'return_uri' => 'https://yourdomain.com/payment/callback'

));

header('Location: ' . $charge['authorize_uri']);

?>

import omise

omise.api_secret = 'skey_test_YOUR_SECRET_KEY'

source = omise.Source.create(

type='mobile_banking_ktb',

amount=100000,

currency='THB'

)

charge = omise.Charge.create(

amount=100000,

currency='THB',

source=source.id,

return_uri='https://yourdomain.com/payment/callback'

)

return redirect(charge.authorize_uri)

Refund Support

// Full or partial refund within 30 days

const refund = await omise.charges.refund('chrg_test_...', {

amount: 100000 // Full or partial amount

});

Testing

Test Amount: ฿1,000 (100000 smallest unit) Expected: Successful payment in test mode

FAQ

What is Krungthai NEXT?

Krungthai NEXT is the mobile banking app from Krungthai Bank (KTB), Thailand's state-owned commercial bank. It's one of Thailand's most widely used banking apps.

What are the transaction limits?

- Minimum: ฿20

- Maximum: ฿2,000,000 per transaction

- Daily limits vary by customer account settings

Can I refund Krungthai payments?

Yes, full and partial refunds are supported within 30 days of the original transaction.

Related Resources

- Mobile Banking Overview - All mobile banking options

- Bank Transfers Overview - All bank payment methods

- Testing - Test your integration