FPX (Financial Process Exchange)

Accept instant online bank transfers from 19+ Malaysian banks via FPX, Malaysia's national interbank payment gateway with widespread adoption across the country.

Overview

FPX (Financial Process Exchange) is Malaysia's national online banking payment gateway operated by PayNet. It enables customers to pay directly from their bank accounts via online banking, making it one of the most popular payment methods in Malaysia for e-commerce.

Key Features:

- ✅ 19+ banks - All major Malaysian banks supported

- ✅ National system - Malaysia's official interbank gateway

- ✅ Instant confirmation - Real-time payment processing

- ✅ High limits - Up to RM30,000 per transaction

- ✅ No registration - Customers use existing online banking

- ✅ Trusted - Operated by PayNet (Bank Negara Malaysia)

Supported Regions

| Region | Currency | Min Amount | Max Amount | Daily Limit |

|---|---|---|---|---|

| Malaysia | MYR | RM1.00 | RM30,000 | Varies by bank |

Supported Banks

FPX supports 19+ major Malaysian banks:

Major Banks:

- Affin Bank

- Alliance Bank

- AmBank

- Bank Islam

- Bank Muamalat

- Bank Rakyat

- BSN (Bank Simpanan Nasional)

- CIMB Bank

- Hong Leong Bank

- HSBC Bank

- Kuwait Finance House

- Maybank

- OCBC Bank

- Public Bank

- RHB Bank

- Standard Chartered

- UOB (United Overseas Bank)

How It Works

Customer Experience:

- Customer selects "FPX" at checkout

- Redirected to FPX gateway

- Selects their bank from list

- Redirected to bank's online banking

- Logs in with online banking credentials

- Reviews and authorizes payment

- Returns to merchant site

Typical completion time: 2-5 minutes

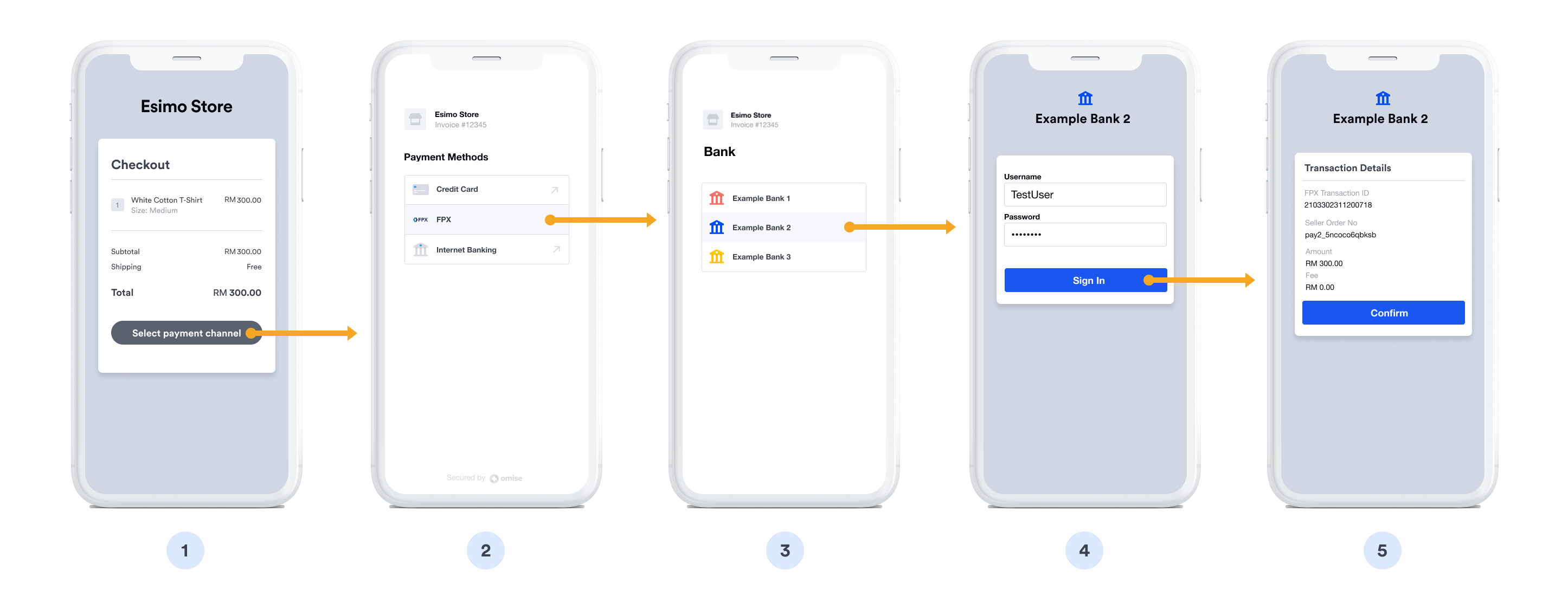

Payment Flow Examples

Bank Selection and Login:

FPX gateway authentication phase:

- ❶ Select FPX - Customer chooses FPX bank transfer at checkout

- ❷ Redirect to FPX - Navigate to Malaysia's FPX payment gateway

- ❸ Choose bank - Select from list of 19+ participating banks

- ❹ Bank redirect - Forward to selected bank's online banking portal

- ❺ Login - Enter online banking username and password

- ❻ 2FA verification - Complete two-factor authentication (TAC/OTP)

- ❼ Authentication complete - Proceed to payment authorization

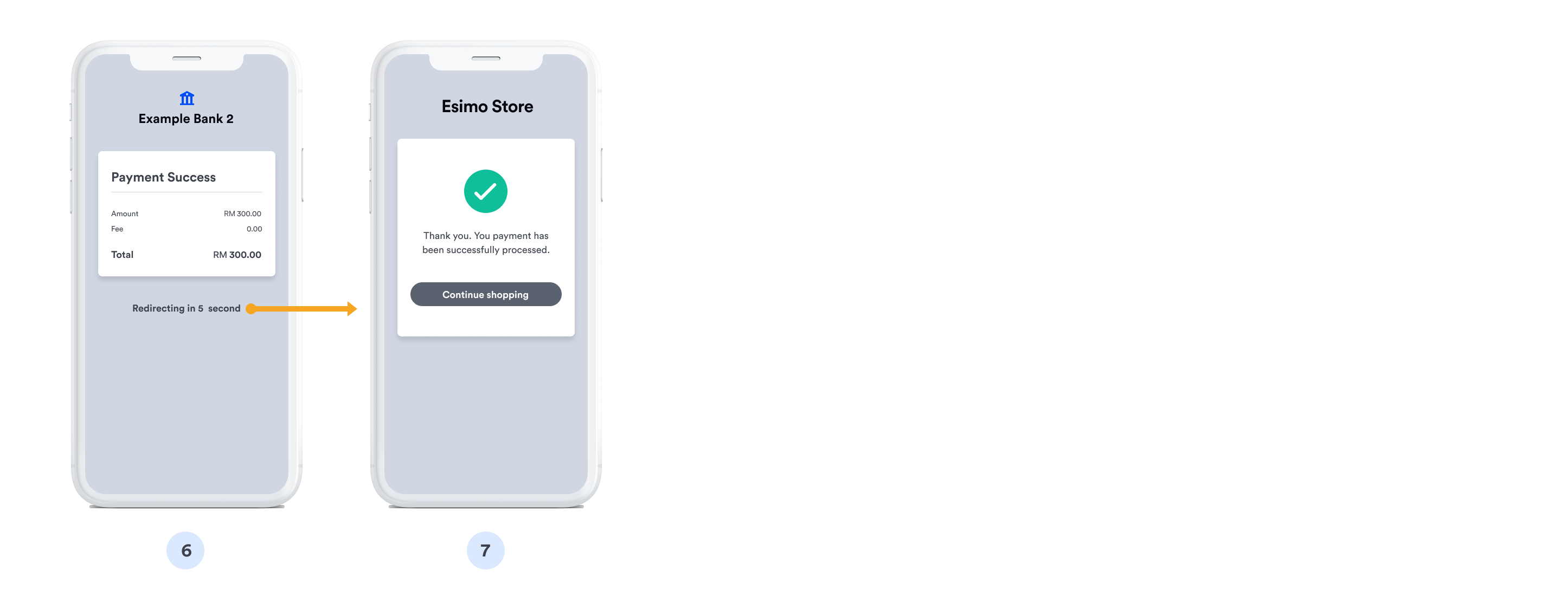

Payment Confirmation:

Transaction authorization and completion:

- ❽ Review details - Merchant name, payment amount, and reference number displayed

- ❾ Verify account - Confirm payment source account

- ❿ Authorize payment - Click confirm button to approve transfer

- ⓫ Processing - Bank processes the interbank transfer via FPX

- ⓬ Success confirmation - Payment complete message with transaction ID

- ⓭ Return to merchant - Redirect back to merchant confirmation page

Implementation

Step 1: Create FPX Source

- cURL

- Node.js

- PHP

- Python

- Ruby

- Go

- Java

- C#

curl https://api.omise.co/sources \

-u skey_test_YOUR_SECRET_KEY: \

-d "type=fpx" \

-d "amount=10000" \

-d "currency=MYR" \

-d "email=customer@example.com"

const omise = require('omise')({

secretKey: 'skey_test_YOUR_SECRET_KEY'

});

const source = await omise.sources.create({

type: 'fpx',

amount: 10000, // MYR 100.00

currency: 'MYR',

email: 'customer@example.com' // Optional but recommended

});

<?php

$source = OmiseSource::create(array(

'type' => 'fpx',

'amount' => 10000,

'currency' => 'MYR',

'email' => 'customer@example.com'

));

?>

import omise

omise.api_secret = 'skey_test_YOUR_SECRET_KEY'

source = omise.Source.create(

type='fpx',

amount=10000,

currency='MYR',

email='customer@example.com'

)

require 'omise'

Omise.api_key = 'skey_test_YOUR_SECRET_KEY'

source = Omise::Source.create({

type: 'fpx',

amount: 10000,

currency: 'MYR',

email: 'customer@example.com'

})

source, err := client.Sources().Create(&operations.CreateSource{

Type: "fpx",

Amount: 10000,

Currency: "MYR",

Email: "customer@example.com",

})

Source source = client.sources().create(new Source.CreateParams()

.type("fpx")

.amount(10000L)

.currency("MYR")

.email("customer@example.com"));

var source = await client.Sources.Create(new CreateSourceRequest

{

Type = "fpx",

Amount = 10000,

Currency = "MYR",

Email = "customer@example.com"

});

Response:

{

"object": "source",

"id": "src_test_5rt6s9vah5lkvi1rh9c",

"type": "fpx",

"flow": "redirect",

"amount": 10000,

"currency": "MYR",

"email": "customer@example.com"

}

Step 2: Create Charge

curl https://api.omise.co/charges \

-u skey_test_YOUR_SECRET_KEY: \

-d "amount=10000" \

-d "currency=MYR" \

-d "source=src_test_5rt6s9vah5lkvi1rh9c" \

-d "return_uri=https://yourdomain.com/payment/callback"

Step 3: Redirect Customer

app.post('/checkout/fpx', async (req, res) => {

try {

const { amount, order_id, customer_email } = req.body;

// Validate amount

if (amount < 100 || amount > 3000000) {

return res.status(400).json({

error: 'Amount must be between RM1 and RM30,000'

});

}

// Create source

const source = await omise.sources.create({

type: 'fpx',

amount: amount,

currency: 'MYR',

email: customer_email

});

// Create charge

const charge = await omise.charges.create({

amount: amount,

currency: 'MYR',

source: source.id,

return_uri: `${process.env.BASE_URL}/payment/callback`,

metadata: {

order_id: order_id

}

});

// Redirect to FPX

res.redirect(charge.authorize_uri);

} catch (error) {

console.error('FPX error:', error);

res.status(500).json({ error: error.message });

}

});

Step 4: Handle Return

app.get('/payment/callback', async (req, res) => {

try {

const chargeId = req.query.charge_id;

const charge = await omise.charges.retrieve(chargeId);

if (charge.status === 'successful') {

await processOrder(charge.metadata.order_id);

res.redirect('/payment-success');

} else if (charge.status === 'failed') {

res.redirect('/payment-failed?reason=' + charge.failure_message);

} else {

res.redirect('/payment-pending');

}

} catch (error) {

res.redirect('/payment-error');

}

});

Step 5: Handle Webhook

app.post('/webhooks/omise', (req, res) => {

const event = req.body;

if (event.key === 'charge.complete' && event.data.source.type === 'fpx') {

const charge = event.data;

if (charge.status === 'successful') {

processOrder(charge.metadata.order_id);

} else if (charge.status === 'failed') {

handleFailedPayment(charge.metadata.order_id);

}

}

res.sendStatus(200);

});

Complete Implementation Example

// Express.js server

const express = require('express');

const omise = require('omise')({

secretKey: process.env.OMISE_SECRET_KEY

});

const app = express();

app.use(express.json());

app.post('/checkout/fpx', async (req, res) => {

try {

const { amount, order_id, customer_email } = req.body;

// Validate amount (RM1 - RM30,000)

if (amount < 100 || amount > 3000000) {

return res.status(400).json({

error: 'Amount must be between RM1 and RM30,000'

});

}

// Validate email

if (!customer_email || !customer_email.includes('@')) {

return res.status(400).json({

error: 'Valid email required for FPX payments'

});

}

// Create source

const source = await omise.sources.create({

type: 'fpx',

amount: amount,

currency: 'MYR',

email: customer_email

});

// Create charge

const charge = await omise.charges.create({

amount: amount,

currency: 'MYR',

source: source.id,

return_uri: `${process.env.BASE_URL}/payment/callback`,

metadata: {

order_id: order_id,

payment_method: 'fpx',

customer_email: customer_email

}

});

// Return authorization URL

res.json({

authorize_uri: charge.authorize_uri,

charge_id: charge.id

});

} catch (error) {

console.error('FPX error:', error);

res.status(500).json({ error: error.message });

}

});

// Callback handler

app.get('/payment/callback', async (req, res) => {

try {

const chargeId = req.query.charge_id;

const charge = await omise.charges.retrieve(chargeId);

if (charge.status === 'successful') {

res.redirect(`/order-success?order=${charge.metadata.order_id}`);

} else {

res.redirect(`/payment-failed?charge=${chargeId}`);

}

} catch (error) {

res.redirect('/payment-error');

}

});

// Webhook handler

app.post('/webhooks/omise', (req, res) => {

const event = req.body;

if (event.key === 'charge.complete') {

const charge = event.data;

if (charge.source.type === 'fpx') {

if (charge.status === 'successful') {

updateOrderStatus(charge.metadata.order_id, 'paid');

sendConfirmation(charge.metadata.customer_email);

} else {

updateOrderStatus(charge.metadata.order_id, 'failed');

}

}

}

res.sendStatus(200);

});

app.listen(3000);

Refund Support

FPX supports full and partial refunds within 6 months:

// Full refund

const fullRefund = await omise.charges.refund('chrg_test_...', {

amount: 10000

});

// Partial refund

const partialRefund = await omise.charges.refund('chrg_test_...', {

amount: 5000 // Half refund

});

Refunds are supported within 6 months of the original transaction. Both full and partial refunds are allowed.

Common Issues & Troubleshooting

Issue: Bank not available

Cause: Customer's bank temporarily unavailable or under maintenance

Solution:

- Show real-time bank availability status (if provided by FPX)

- Display alternative payment methods

- Provide estimated downtime information

Issue: Payment timeout

Cause: Customer abandoned payment at bank's online banking page

Solution:

// Set reasonable timeout

const TIMEOUT = 30 * 60 * 1000; // 30 minutes

setTimeout(() => {

if (!paymentConfirmed) {

showTimeoutMessage();

allowRetry();

}

}, TIMEOUT);

Issue: Transaction limit exceeded

Error: Amount exceeds bank's limit

Solution:

- Show clear limit information (RM30,000 maximum)

- Suggest splitting into multiple transactions

- Offer alternative high-value payment methods

Issue: Customer closed browser

Cause: Return URI not called

Solution:

- Implement webhook handling (more reliable)

- Provide order status check page

- Send email confirmation

Best Practices

1. Display Bank Selection

<div class="fpx-instructions">

<h3>Pay with FPX Online Banking</h3>

<p>You'll be able to select from these banks:</p>

<ul class="bank-list">

<li>Maybank</li>

<li>CIMB Bank</li>

<li>Public Bank</li>

<li>RHB Bank</li>

<li>Hong Leong Bank</li>

<li>AmBank</li>

<li>and 13 more banks...</li>

</ul>

<p><strong>Requirements:</strong></p>

<ul>

<li>Online banking enabled on your account</li>

<li>Sufficient balance</li>

<li>Transaction amount: RM1 - RM30,000</li>

</ul>

</div>

2. Collect Email Address

// Email is optional but recommended for receipts

function validateCheckout(data) {

if (!data.email || !data.email.includes('@')) {

throw new Error('Please provide a valid email address');

}

return true;

}

3. Validate Amount

function validateFPXAmount(amount) {

const MIN = 100; // RM1.00

const MAX = 3000000; // RM30,000.00

if (amount < MIN) {

return 'Minimum amount is RM1.00';

}

if (amount > MAX) {

return 'Maximum amount is RM30,000.00';

}

return null; // Valid

}

4. Use Webhooks

// Webhook is primary notification method

app.post('/webhooks/omise', handleWebhook);

// Callback is backup

app.get('/payment/callback', handleCallback);

5. Handle Bank Maintenance

// Check for known maintenance windows

const MAINTENANCE_SCHEDULE = {

'maybank': { day: 'sunday', time: '00:00-06:00' },

'cimb': { day: 'sunday', time: '01:00-05:00' }

};

function checkMaintenanceWindow(bank) {

const now = new Date();

// Check if current time falls in maintenance window

// Show warning to customer

}

FAQ

What is FPX?

FPX (Financial Process Exchange) is Malaysia's national online banking payment gateway operated by PayNet. It connects 19+ Malaysian banks for instant online payments.

Do customers need to register for FPX?

No, customers use their existing online banking accounts. No separate FPX registration required.

What are the transaction limits?

- Minimum: RM1.00

- Maximum: RM30,000 per transaction

- Daily limits: Vary by bank (typically RM30,000-RM100,000)

How long does settlement take?

FPX payments are processed instantly, but settlement to your merchant account typically occurs within 1-3 business days. Check your Omise dashboard for settlement schedules.

Can I refund FPX payments?

Yes, FPX supports both full and partial refunds within 6 months of the original transaction.

What if customer's bank is under maintenance?

Banks occasionally have scheduled maintenance (usually Sunday mornings). Customers can:

- Wait for bank to be available

- Use a different bank

- Choose an alternative payment method

Is FPX available 24/7?

FPX gateway is available 24/7, but individual banks may have maintenance windows (typically Sunday early morning). Most banks are available 24/7.

Testing

Test Mode

FPX can be tested using your test API keys. In test mode:

Test Credentials:

- Use test API keys (skey_test_xxx)

- Currency: MYR (Malaysian Ringgit)

- Email field is recommended for testing

- No actual bank account required

Test Flow:

- Create source and charge with test API keys

- Customer redirects to test

authorize_uri - Test page simulates FPX bank selection and authorization

- Use Omise Dashboard Actions to mark charge as successful/failed

- Verify webhook and return_uri handling

Testing Implementation:

// Test FPX payment

const source = await omise.sources.create({

type: 'fpx',

amount: 10000, // RM100.00

currency: 'MYR',

email: 'customer@example.com'

});

const charge = await omise.charges.create({

amount: 10000,

currency: 'MYR',

source: source.id,

return_uri: 'https://example.com/callback'

});

console.log('Test authorize URL:', charge.authorize_uri);

Test Scenarios:

- Successful payment: Complete redirect flow and order processing

- Failed payment: Test error handling and user messaging

- Amount limits: Test RM1 minimum and RM30,000 maximum

- Bank selection: Test different bank flows

- Timeout: Test abandoned payment scenarios (customer doesn't complete)

- Return URI: Verify proper return after payment

- Webhook delivery: Verify all webhook events are received

Important Notes:

- Test mode doesn't connect to real FPX or bank servers

- Use dashboard to simulate payment status changes

- Test the complete redirect flow

- Verify webhook handling for all charge statuses

- Test both successful and failed scenarios

- Validate email field collection

For comprehensive testing guidelines, see the Testing Documentation.

Related Resources

- Bank Transfers Overview - All bank transfer options

- DuitNow - Alternative Malaysia method

- Mobile Banking - Thailand options

- Testing - Test FPX integration

- Refunds - Refund policies